Startup Business Models and Pricing

Startup Business Models and Pricing | Startup School (opens in a new tab)

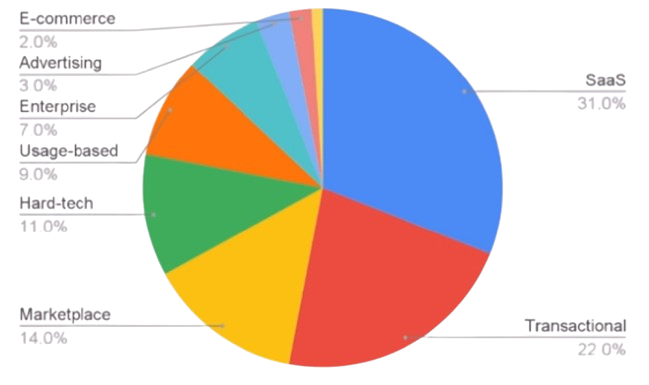

The 9 business models of nearly every $B company

A business model is a fancy term for “how you make money”

SaaS

PRIMARY METRICS:

- Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR)

- Growth Rate: Measured weekly or monthly

- Net Revenue Retention: % of recurring revenue retained from a prior period

- CAC: Costs to acquire a new customer

TAKEAWAYS:

- All the benefits of recurring revenue

- Can have non-recurring revenue, but don’t include in ARR/MRR

- Usually sold to businesses, ideally on annual contracts

- Growth can be driven by direct sales, self-serve acquisition channels, or both

Market Place

- Facilitate transactions with buyers & sellers

PRIMARY METRICS:

- Gross Merchandise Value (GMV): Total sales volume transacted

- Net Revenue: Fees charged for transactions (often a % take rate)

- Growth Rate

- User Retention: % of month 1 customers that purchase in month 2, etc

TAKEAWAYS:

- Hard to get off the ground, chicken & egg problem

- Need to scale supply and demand in sync

- Network effects at scale drive exponential growth

- When they work, often become dominant winner-take-all winners

Usage Base

- Pay-as-you-go based on consumption

PRIMARY METRICS:

- Monthly Revenue (not recurring!)

- Growth Rate

- Revenue Retention: % of revenue from last month’s customers in this month

- Gross Margin: Revenue - Cost of Goods Sold (COGS)

TAKEAWAYS:

- Don’t confuse usage-based revenue with recurring revenue

- Charge per API request, # of records, data usage, etc

- Grow as your customers grow

- Product and pricing scale to support tiny startups to large enterprises

Advertising

- Sell ads to monetize free users

PRIMARY METRICS:

- Daily Active Users (DAU): Unique users active in 24 hours

- Monthly Active Users (MAU): Unique users active in 28 days

- User Retention: % of active users on D1/7/30/etc

- CPM (Cost Per Thousand) or CPC (Cost Per Click)

TAKEAWAYS:

- Typically consumer social products with huge scale

- The customer is the advertiser, not the end user

- Users are the product being sold

- Need billions of impressions each month

- Registered Users is a vanity metric

Subscription

- Product or service sold on a recurring basis, usually to consumers

PRIMARY METRICS:

- Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR)

- Growth Rate: Measured weekly or monthly

- User Retention: % of month 1 customers that purchase in month 2, etc

- CAC

TAKEAWAYS:

- Recurring revenue is the most valuable revenue

- Usually sold to consumers, often paying monthly

- Usually lower price points, from a higher volume of customers

- Growth driven by scalable, self-serve acquisition channels

Transactional

Facilitate Transactions & take a cut

PRIMARY METRICS:

- Gross Transaction Value (GTV): Total payment volume transacted

- Net Revenue: Fees charged for transactions (often a %)

- User Retention: % of month 1 customers that purchase in month 2, etc

- CAC

TAKEAWAYS:

- Usually fintech and payment businesses

- One-time transactions rather than recurring

- Often high volume with a low fee (1-3% is common)

- Best transactional businesses have extremely consistent revenue from high repeat usage

Hard tech/Bio/Moonshots

- Hard businesses with lots of technical risk and long time horizons

PRIMARY METRICS:

- Milestones: Progress towards the long-term vision

- Signed contracts

- Letters of Intent (LOIs): Non-binding contracts indicating interest to purchase

TAKEAWAYS:

- Often take years to get to a live product because of technical and/or regulatory risk

- Impressive technical milestones or experimental data can de-risk the tech

- Revenue is often years away, so signed LOIs are usually the best way to show customer interest

Enterprise

- Sell large contracts to huge companies

PRIMARY METRICS:

- Bookings: Total signed contract value (recurring + non-recurring)

- Revenue: Recognized when delivering on the contract

- Annual Contract Value (ACV): Total contract value / # of years

- Pipeline: Top of funnel → Demo → Close

TAKEAWAYS:

- Very few customers, much larger deals ($100k+/year)

- Growth driven by direct sales

- Often begin with paid pilots or LOIs

- Usually long sales cycles, with many gatekeepers

- The buyer is not always the end user

- Lumpy growth: measuring m/m growth rate doesn't make as much sense

E-Commerce

- Sell products online

PRIMARY METRICS:

- Monthly Revenue: Total sales

- Growth Rate: Measured weekly or monthly

- Gross Margin/Unit Economics: Revenue - Cost of Goods Sold (COGS)

- CAC

TAKEAWAYS:

- Includes D2C brands and Shopify stores

- Not marketplaces, so keep 100% of each sale

- Higher COGS = lower margins

- Products often commoditized

- Need to be excellent at user acquisition and operations/unit economics

Overall Lessons

What’s not in the top 100

- Services/Consulting Businesses:

- Non-recurring revenue, scale with people, low margins

- Affiliate Businesses:

- Too far away from the transaction

- Hardware Businesses:

- Require lots of capital, has low margins

- Businesses build on other platforms

- Too much platform risk

- Highly predictable

- Higher LTVs (Customer Lifetime Value)

- Lower CACs (Customer Acquisition Cost)